Modernizing a Legacy Enterprise Platform: $2M Investment, $17M Renewal, and 100% YoY Growth

Role: Lead Product Designer (Vision + Systems + Research + IA)

Project Summary: Defined and led a 5-year design vision that modernized Mastercard’s enterprise expense ecosystem.

Key Outcomes

100% YoY growth in mobile MAU (1,000 → 4,000+)

125% increase in enterprise adoption (200 → 450 customers)

App rating improved from 2.8 → 4.2 across 100+ reviews

Secured $2M investment for the product vision

Contributed to a $17M renewal with platform improvements

Part I

What I inherited > Context > What I changed

Understanding the system

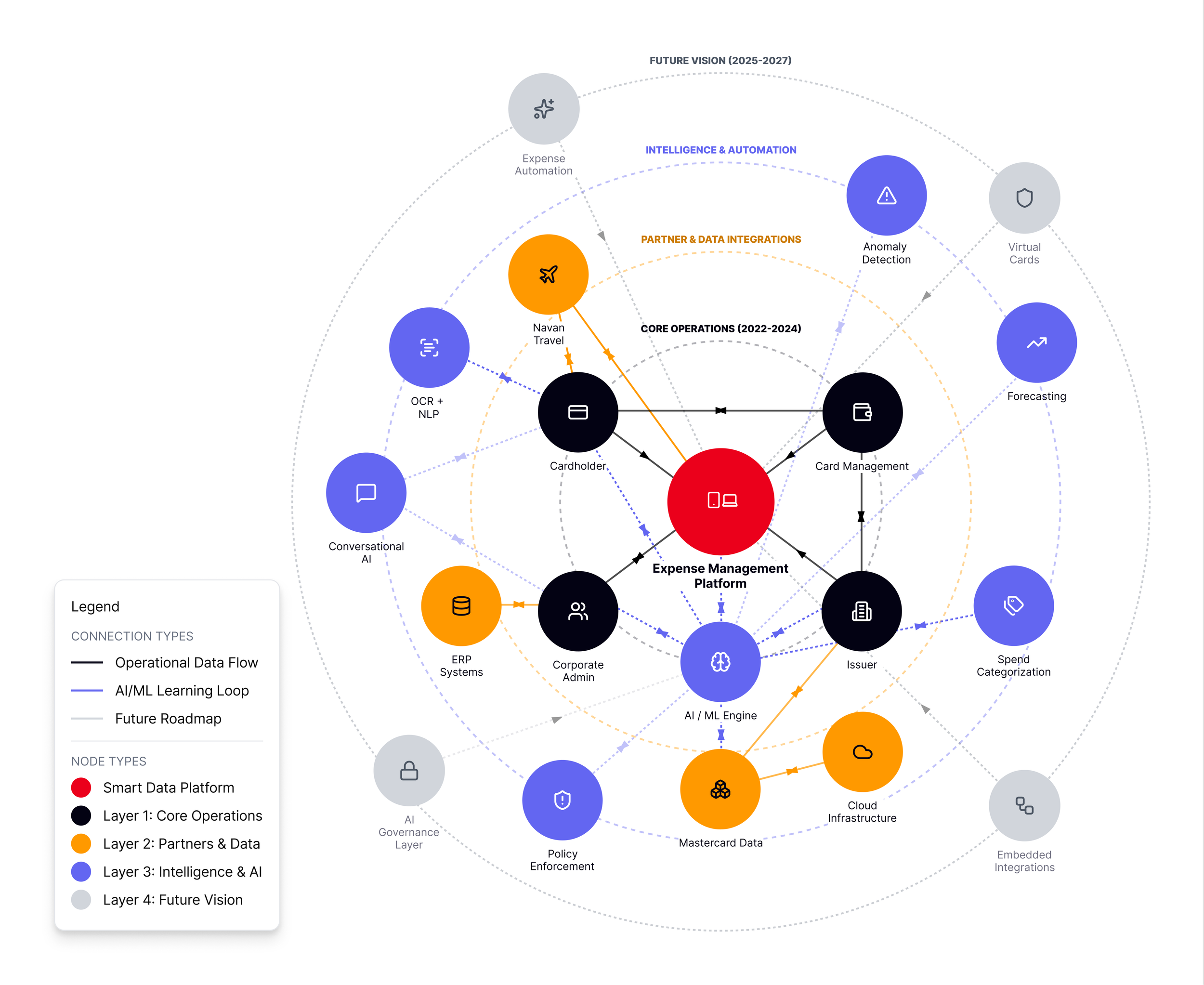

Original Ecosystem

Baseline operational flows

Inherited system focused on core transactions with minimal intelligence and limited integrations — creating operational bottlenecks and manual workload at scale.

Evolved Ecosystem

Scalable, intelligent platform

Redesigned ecosystem introducing AI loops, broader integrations, and a clear path for future growth — enabling automation, clarity, and scalable expansion.

End-to-end Research Framework

Cross-functional, Iterative Research Program

I led the full 3-phase research program, partnering with Product, Engineering, and Sales to align on user needs and business goals. The framework used continuous feedback loops to refine insights and validate assumptions throughout the process.

Legacy Desktop Experience

Desktop workflows were slow, unclear, and overly manual — causing approver delays and repeated errors across high-volume teams.

Screen 1: Expense Inbox (List View)

The inbox made it difficult to access information: filters were buried, visual hierarchy was flat, and high-volume lists were hard to scan. Approvers struggled to trust what they were seeing due to statuses, grouping, and totals lacked clarity.

Screen 2: Expense Details (Modal View)

The detail view relied on a large modal that blocked context and forced users through a slow, multi-step workflow. Critical information was scattered across tabs, reducing transparency and making even simple approvals inefficient.

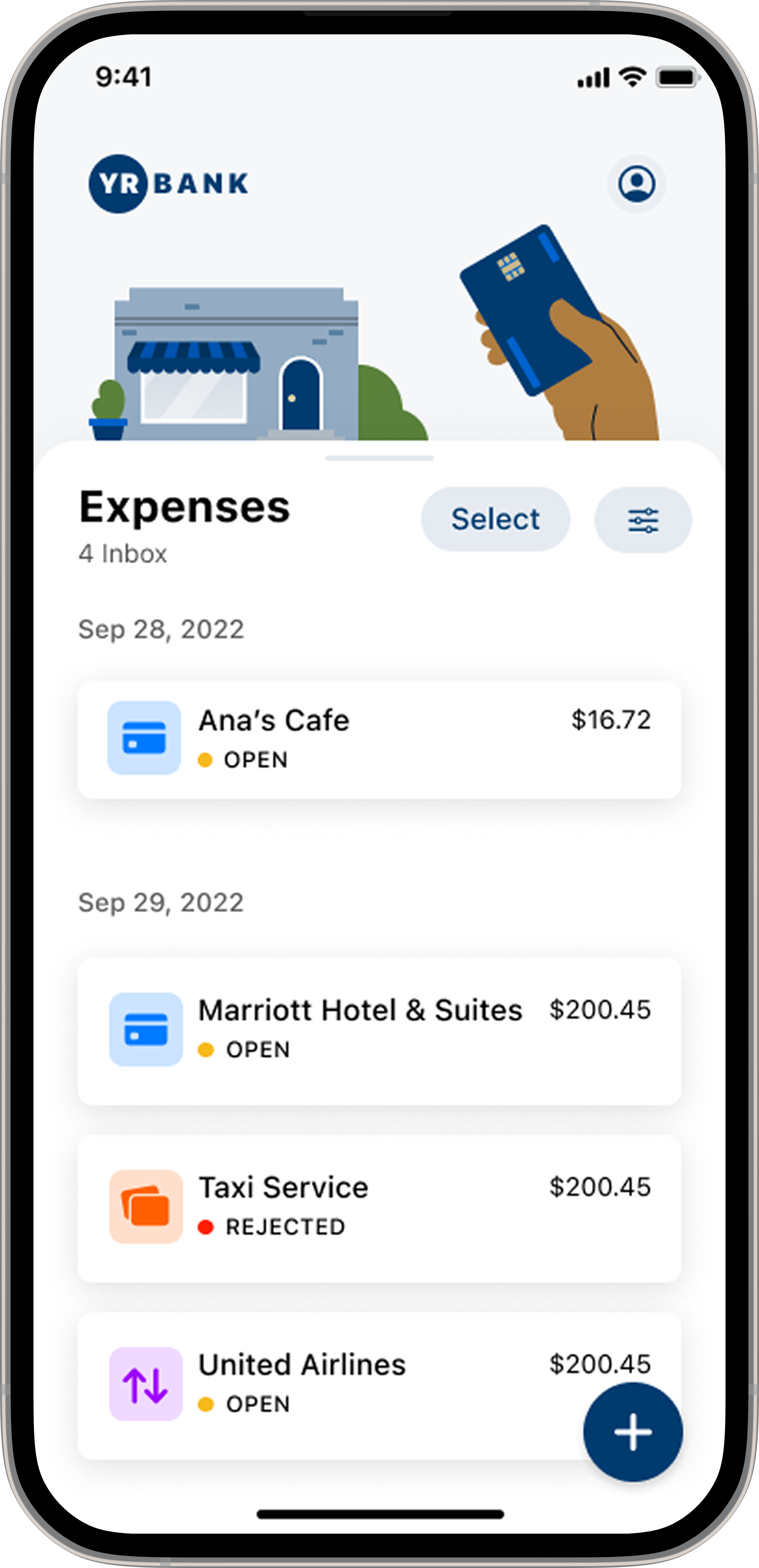

Legacy Mobile Experience

Mobile lacked hierarchy, clarity, and functionality — preventing users from acting quickly or trusting what they saw.

Screen 1: Mobile Inbox

The app lacked functionality. Limited visual hierarchy made it hard to scan status and spot priorities, hindering decision-making.

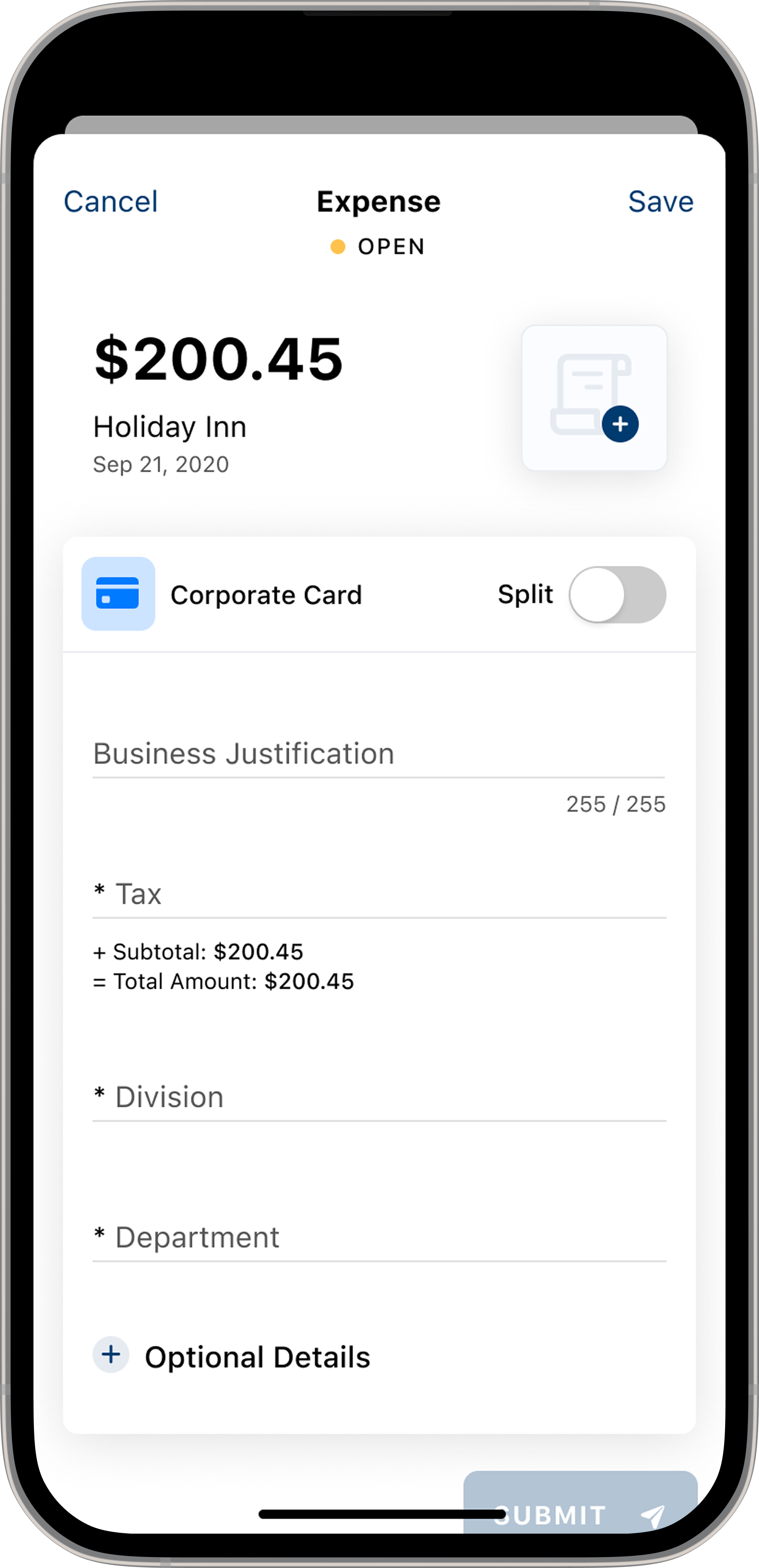

Screen 2: Mobile Details

The long, manual, form-heavy layout slowed users down. Critical details weren’t clear, reducing confidence in the workflow.

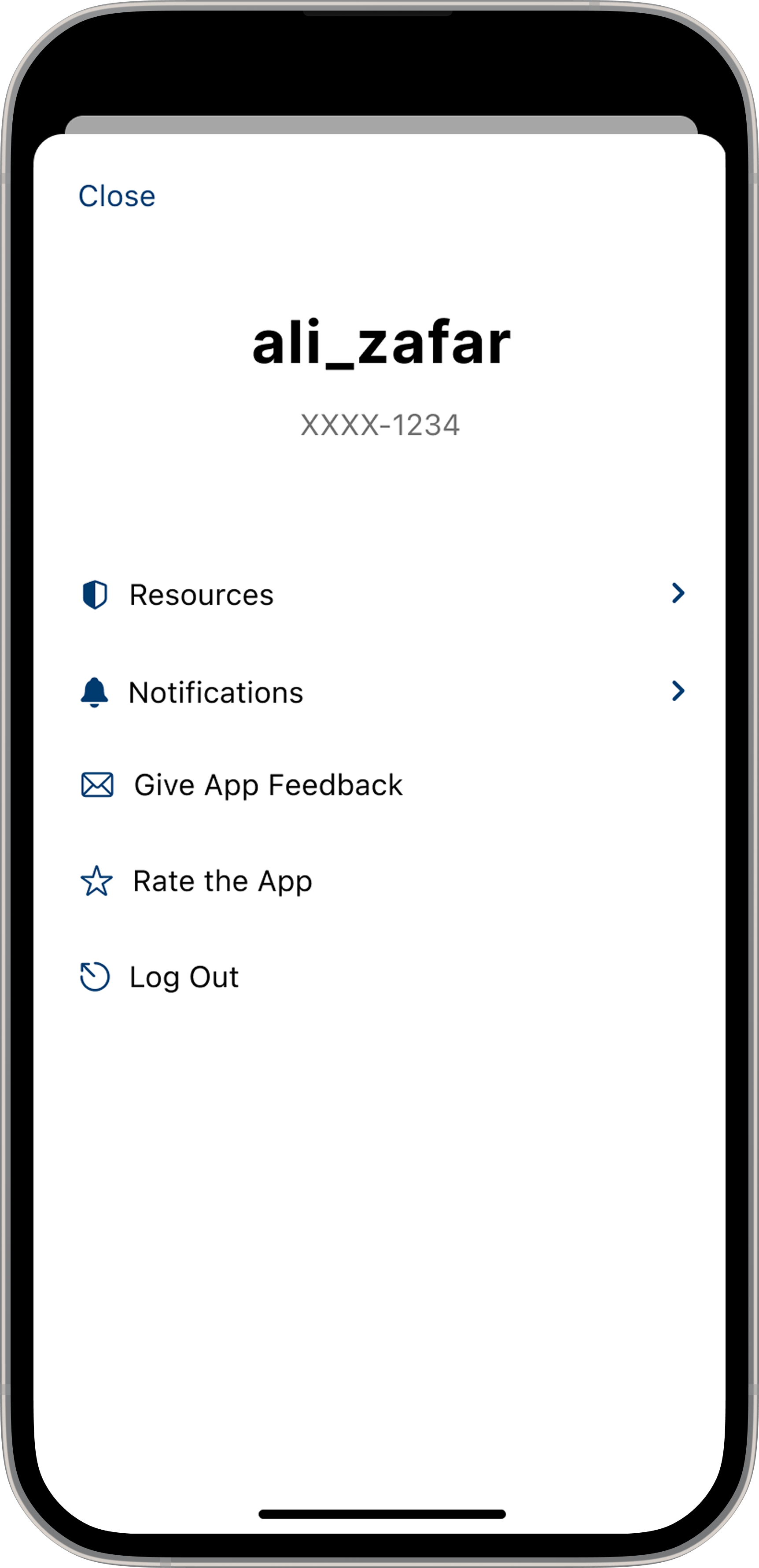

Screen 3: Mobile Profile

A sparse, utilitarian layout offered little guidance. Essential account actions were missing, disconnected, and hard to navigate.

Part 2

What I learned > How I applied findings > What I decided

Insights and definition

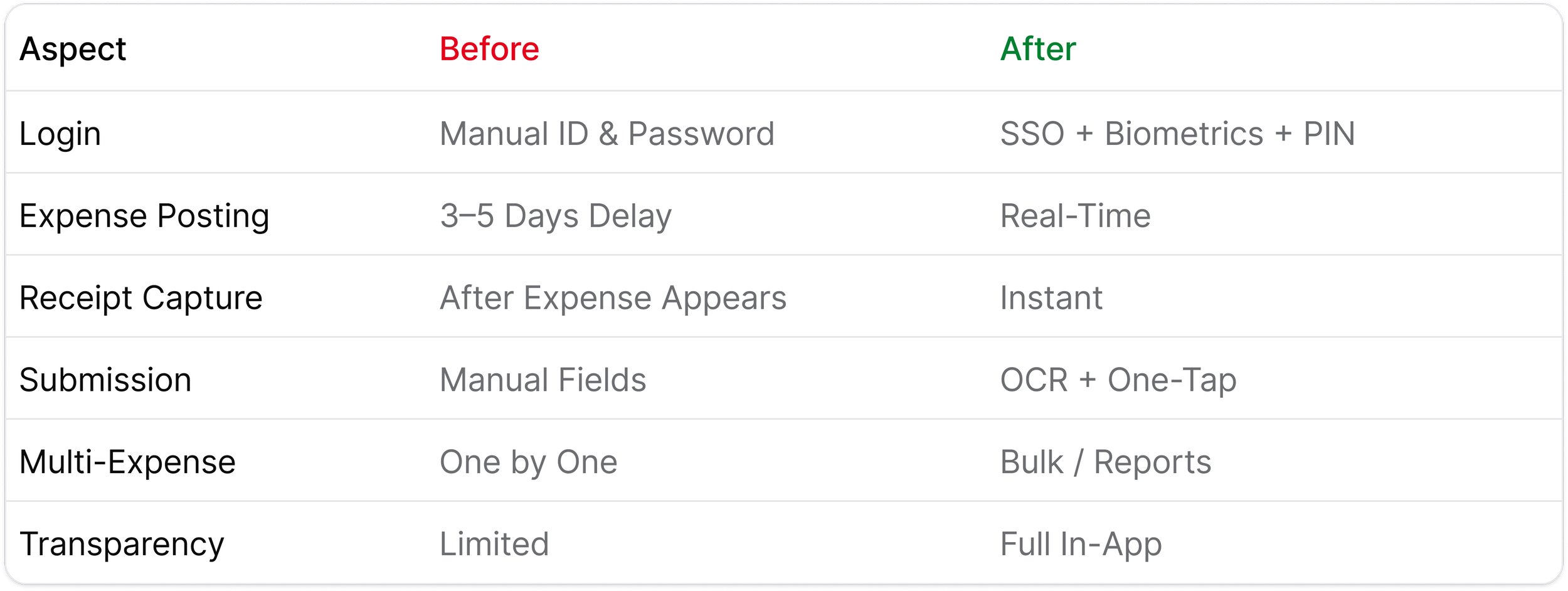

Cardholder Journey

From Manual to Real-Time Expense Management

Before redesign, cardholders faced batch delays, manual entry, and outdated login processes. After redesign, the experience became proactive, automated, and cardholder-first - with real-time transparency, simplified submission, and secure modern authentication.

Before Redesign - Current State

After Redesign - Future State

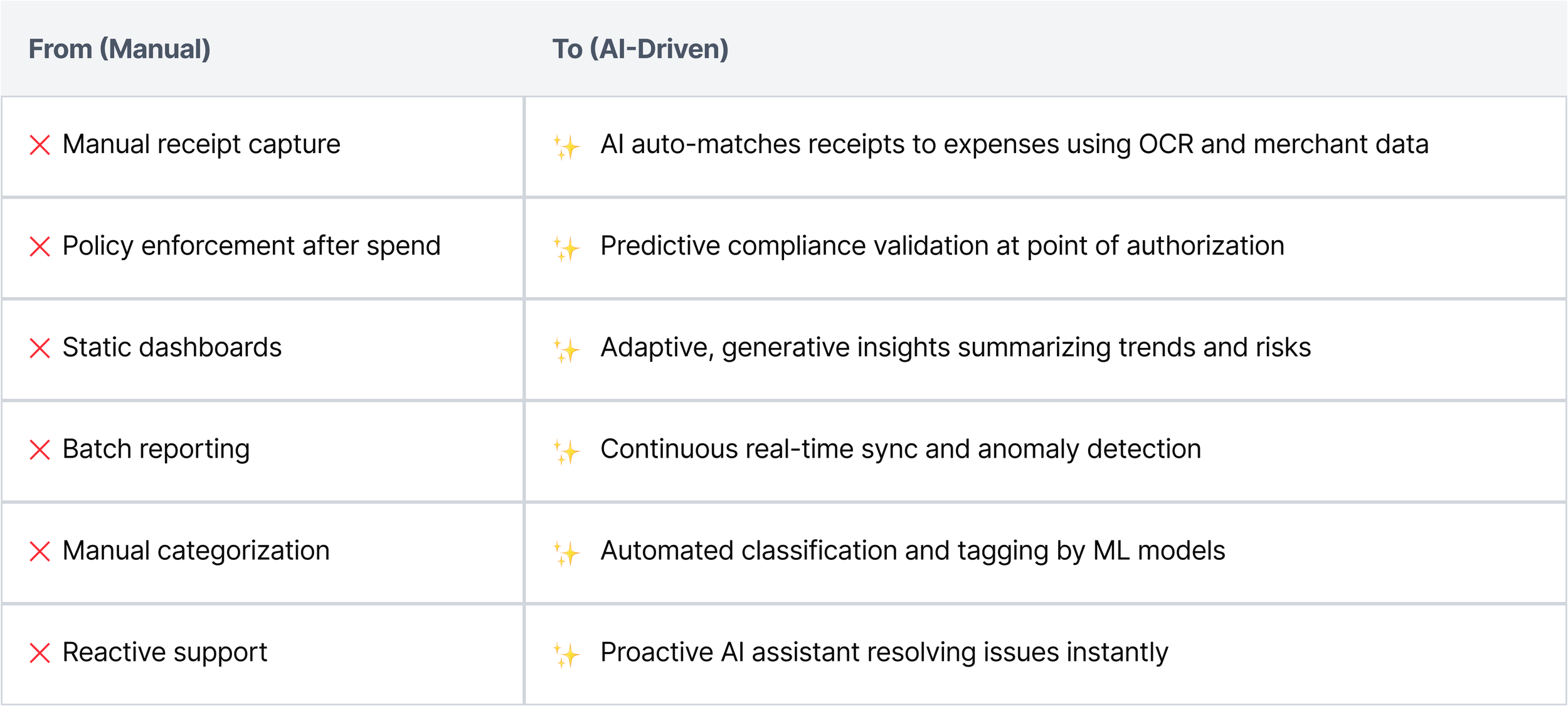

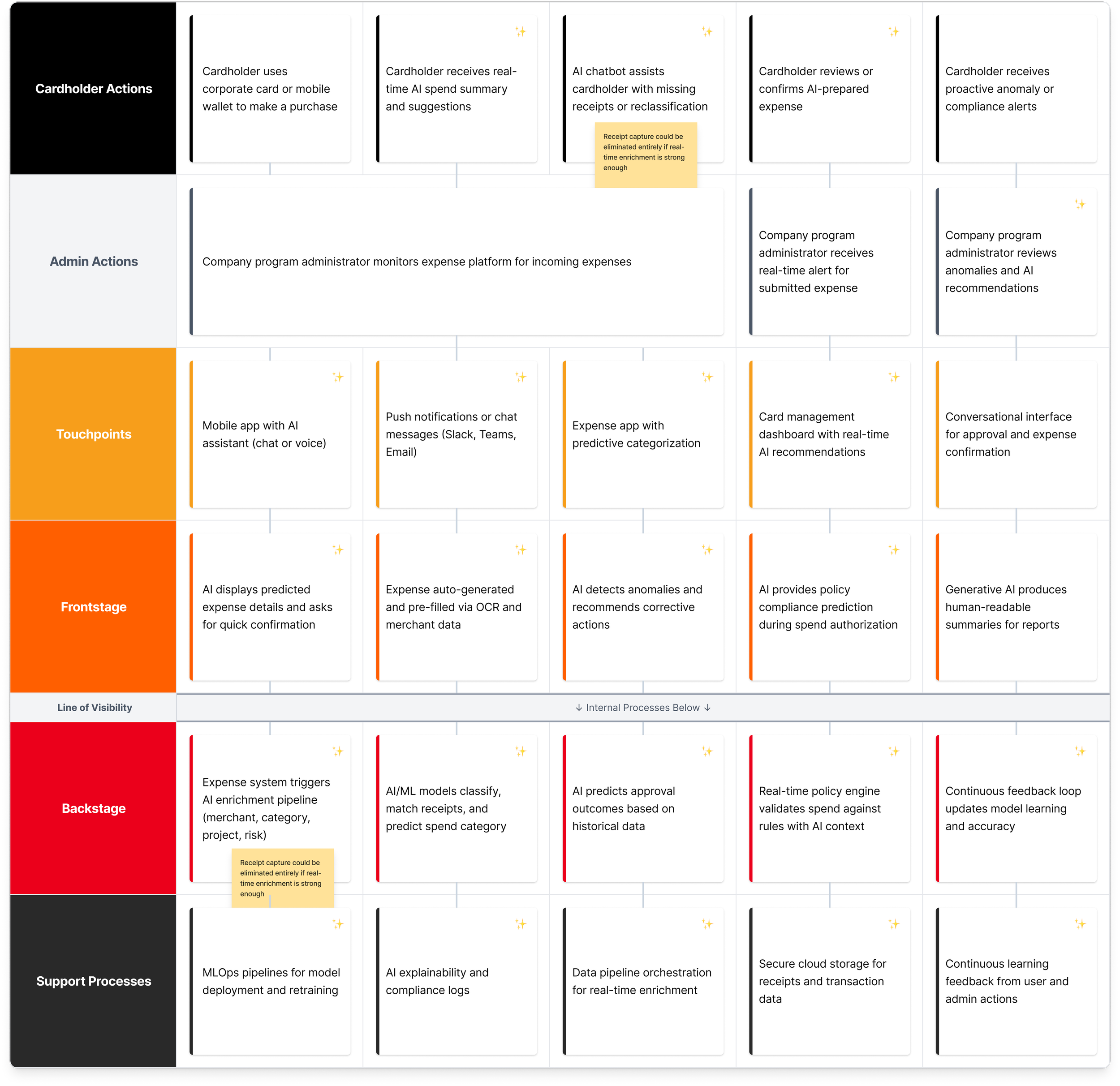

Corporate Finance Service Blueprint: AI-First Real-Time Expensing

An updated AI-driven service blueprint for corporate expense management, illustrating automation, prediction, and conversational support across the full spend lifecycle.

Research-Informed Design Principles

These design principles emerged from cross-functional user research with cardholders, finance administrators, and compliance teams, and guided the creation of a unified, real-time expense management experience.

Product Design Roadmap 2022-2025

A product design roadmap showing initiatives that were completed (✓) and deferred (○) due to time, technical feasibility, internal product overlap/ownership negotiations, and technical debt. This roadmap informed quarterly planning, reduced design/engineering misalignment, and set expectations for long-term platform modernization.

Part 3

Seamless access > Real-time transparency > Simplified management

Solutions and highlights

Providing seamless access

I designed a modern authentication flow using company sign-on and native biometrics to eliminate password friction and streamline secure access into the expense management app.

Reduced friction: Biometric unlock replaces repetitive password entry and builds trust.

Predictable transitions: Consistent loading and fallback logic strengthen trust.

OS-native patterns: iOS authentication and permission flows ensure security and familiarity.

Real-time transparency

I designed an end-to-end real-time expensing experience, from biometric authentication to instant receipt capture, ML-powered extraction, and automatic expense sync, to reduce manual entry and shorten the reimbursement cycle from days to seconds.

Reduced authentication friction using pass-through biometric unlock and device pin for robust security and immediate access.

Auto-capture & ML extraction to eliminate manual entry.

Inline confirmation so the user gets clear, fast feedback.

Simplified expense management

I designed a real-time expense approval flow to reduce reviewer pain points by surfacing AI-generated insights, auto-categorization, and one-tap approvals.

AI surfacing confidence indicators to reduce review time.

Inline detail drawer for rapid triage without losing table context.

One-click bulk approvals based on rules + model certainty.